Running a business involves a lot of moving parts, and sometimes you need a financial boost to get things moving. At Orchard Mortgage Brokers, we offer assistance with securing a range of business loan options tailored to meet the unique needs of Sunshine Coast businesses.

Whether you’re looking to expand, invest in new equipment, or manage cash flow, we can help you find the right financing solution. In this latest blog update, we will be exploring:

- The types of business loans we can help with

- The benefits of getting a business loan

- FAQs about business loans

- What you need to apply for a business loan

Types of Business Loans We Can Help With

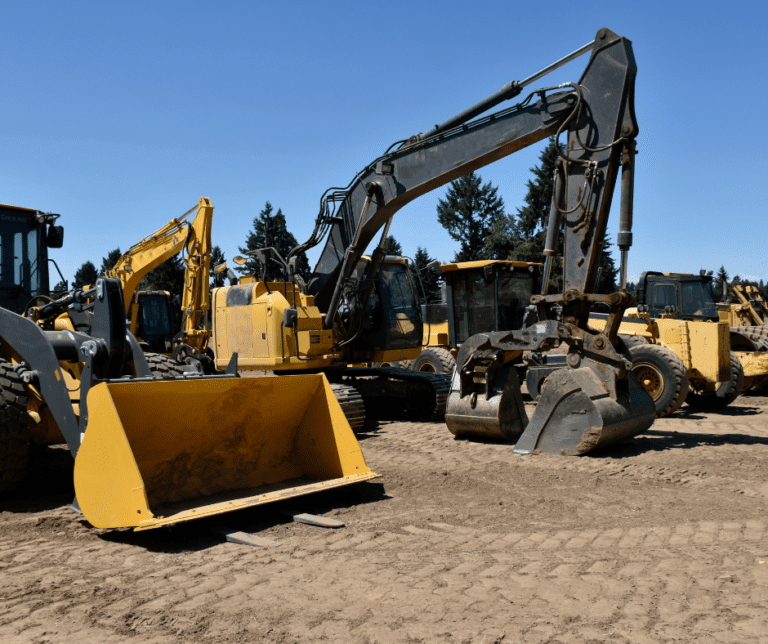

Equipment Loans

If you need to purchase new machinery or vehicles, an equipment loan (also known as a chattel mortgage) might be the right option. With this loan, you own the asset from the beginning, and the loan is secured against it. This can be particularly beneficial for self-employed individuals, allowing you to make regular payments while keeping your cash flow accessible. Plus, if the asset is used to generate income, there are potential tax benefits.

Hire Purchases

A hire purchase allows you to hire equipment over a fixed term, with tailored payments to suit your business needs. You’ll own the asset after the final payment, making it a good option for businesses that want to eventually own their equipment without a large upfront cost.

Finance Leases

With a finance lease, you don’t need to pay an upfront deposit. Instead, the financier owns the equipment during the lease term. You can choose from various terms to match your financial situation. At the end of the lease, you typically have the option to purchase the equipment at a reduced rate.

Novated Leases

A novated lease, also known as a salary packaging arrangement, is an agreement between an employer, employee, and a lease company. The employer makes the lease payments on behalf of the employee, deducting the costs from the employee’s pre-tax income. This arrangement can reduce taxable income, making it a tax-effective way to lease a vehicle.

Benefits of Business Loans

There are lots of different reasons why businesses take out business loans. Here are some of the best benefits that a business loan can provide for your business:

Improved Cash Flow

Loans can help manage cash flow, ensuring you have the funds needed for day-to-day operations.

Expansion Opportunities

Are you looking to expand your business? Financing can provide the capital needed to expand your business, invest in new locations, or hire additional staff.

Equipment and Inventory

Loans make it easier to purchase essential equipment or inventory without depleting your cash reserves.

Tax Benefits

Depending on the type of loan and its purpose, there may be tax advantages that can help reduce your overall tax liability.

FAQs About Business Loans

What is the interest rate on a business loan?

Interest rates on business loans vary depending on the lender, loan type, and your business’s financial health. At Orchard Mortgage Brokers, we work with multiple lenders to find the most competitive rates for you.

How long does it take to get approved for a business loan?

Approval times can vary. Generally, equipment loans and finance leases can be approved quickly, often within a few days. More complex loans may take longer.

Can I get a business loan with bad credit?

While having a good credit score helps, it’s not the only factor lenders consider. We work with various lenders, some of which offer options for businesses with less-than-perfect credit.

What You Might Need for a Business Loan Application

Applying for a business loan typically requires a few different types of documentation. Let’s take a look at what you may need to provide during a business loan application:

- Business Plan: A detailed business plan that outlines your business model, market analysis, and financial projections.

- Financial Statements: Recent financial statements, including profit and loss statements, balance sheets, and cash flow statements.

- Tax Returns: Personal and business tax returns for the past few years.

- Bank Statements: Recent bank statements to show cash flow and banking history.

We’ll guide you through the application process, helping you gather the necessary documents and present a strong case to potential lenders.

About Us - Orchard Mortgage Brokers

At Orchard Mortgage Brokers, our mission is to make securing a business loan as straightforward and stress-free as possible. Based on the Sunshine Coast, our experienced finance broker team understands the local business landscape and works tirelessly to find the right financial solutions for our clients.

Our brokers have access to over 60 lenders, providing a wide range of loan products to choose from. We don’t just look at the numbers, we take the time to understand your business and its unique needs.

This personalised approach allows us to recommend the right financing options and terms tailored specifically for you.

Get in Touch With Our Sunshine Coast Brokers

If you’re ready to take your business to the next level, reach out to us at Orchard Mortgage Brokers. Our friendly team is here to answer your questions, guide you through the loan process, and find the right financial solution for your business. Give us a call at 07 5475 4500 or visit our website to learn more.

Let’s work together to secure the financing you need to grow your business.

Stay Updated With Michael Wills & Orchard Mortgages

Don’t miss out on the latest update from Orchard Mortgages, with news and tips on personal loans, home loans, business loans and more! Stay tuned to our blog, and don’t forget to follow us on Facebook, Instagram.

Licensing statements: Orchard Mortgage Brokers (Qld) Pty Ltd ACN 671 112 137 Trading As Orchard Mortgage Brokers is an authorised Credit Representative 556459 under Australian Credit Licence 389328 General disclaimer: This page provides general information only and has been prepared without taking into account your objectives, financial situation or needs. We recommend that you consider whether it is appropriate for your circumstances and your full financial situation will need to be reviewed prior to acceptance of any offer or product. Subject to lenders terms and conditions, fees and charges and eligibility criteria apply