The latest June interest rate rise has attracted more attention by Australian home owners.

Reserve Bank has increased interest rates by a whopping .5% and we are being told that there will be more to come.

Many of our clients over the past 10 years haven’t had to deal with rising interest rates.

You need to get ahead of these rate rises! It’s time to confront what is ahead of us all.

Will There Be More Rate Hikes in 2022?

Dr Lowe (the Australian Reserve Bank Governor) says the reserve bank will more than likely keep raising interest rates over the coming months in 2022.

Here is a link to the official statement my Philip Lowe on 7th June 2022.

“Higher prices for electricity and gas and recent increases in petrol prices mean that, in the near term, inflation is likely to be higher than was expected a month ago.” Philip Lowe

When Should I See a Mortgage Broker?

Mortgage Brokers help their clients and always act in their best interest, Michael Wills and his team are available to help you in relation to your home loan. Here are some ideas on when it’s time to speak with a mortgage professional:

💡 If you find that you are needing a credit card or starting to use a credit card more than you have before, a mortgage review may be needed.

💡 If you find that you are worried about your mortgage payments.

💡 If you have feeling that you don’t understand what’s going on with the banks and the rate increases.

💡 If you have concerns about rising household costs and want to talk to someone about your living expenses.

💡 If you need help to work on your needs and goals in relation to your home loan.

💡 If you are unsure about what you can afford to borrow.

💡 If you are unsure about how your loan works and what it costs (including rates, fees and features).

💡 If you are thinking about applying for a new loan and need help to manage the process.

According to Moneysmart.gov.au “A mortgage broker is the go-between who deals with lenders and banks to arrange a home loan. Mortgage brokers must as in your best interest when suggesting a finance or a loan for you.”

What Does Interest Rate Rise Mean for Australia?

The most obvious answer is that people with mortgages will pay more in interest.

A mortgage of $500 000 over 25 years will increase by approximately $133pm.

In this article by Kate Bettes from UNSW, she explains some important points:

“The price of food, materials and fuel has surged, with the cost of new dwelling purchases by owner-occupiers also rising.

But why is rising inflation linked to a rise in interest rates?

Interest rates are the main tool used by central banks to manage the rates of inflation.

In layman’s terms, raising interest rates makes borrowing money more expensive, but it can also lead to more returns on savings and super (which earn interest on growth).

When borrowing becomes expensive, this can also mean less demand for goods and services.”

Borrowing money might become harder for some people.

Saving money might become more challenging for some people.

People with mortgages should look at their current financial situation and look at their spending habits.

If you wondering “Should I Fix My Home Loan?” Read this article.

How To Set A budget

The first step is get your “paperwork” (emails, bank statements, receipts etc) organised. This is often the most challenging!

Just dive in and start, the more time you spend getting things tidy and organised the easier it is to set a budget.

Some people like setting a monthly budget, some people like setting a weekly budget – it doesn’t matter! Just make it feel good to you.

Setting a budget can feel scary, but it’s just about getting a good picture of how much of your money is going out and how much is coming in.

Read these easy steps to help you get started – How to Do a Budget

Try using this budget tool https://moneysmart.gov.au/budgeting/budget-planner

8 tips when setting a budget:

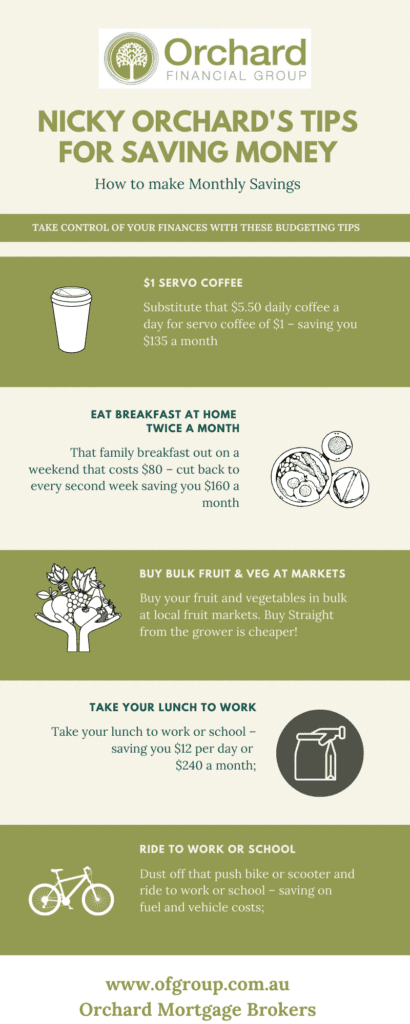

- Substitute that $5.50 daily coffee a day for servo coffee of $1 – saving you $135 a month;

- That family breakfast out on a weekend that costs $80 – cut back to every second week saving you $160 a month;

- Buy your fruit and vegetables in bulk at local fruit markets;

- Takeaway meals for the family, $50 a week – cut back to once a month saving you $150;

- Take your lunch to work or school – saving you $12 per day or $240 a month;

- Dust off that push bike or scooter and ride to work or school – saving on fuel and vehicle costs;

- Have a garage sale, clean out that wardrobe, pull out the monopoly, have a BBQ with friends; or

- Get a second job or for some people, get a job! Everywhere I look at the moment, businesses are looking for staff.

Sunshine Coast Mortgage Brokers | Orchard Mortgage Brokers

We know a lot of people feel unsure and have a lot of questions. Orchard Mortgage Brokers want to help you navigate these current times. At Orchard Mortgage Brokers Sunshine Coast, we love taking time helping and listening to our clients.

So, if you’re worried about potential interest rate increases in the future book a “no obligation” 30-minute appointment with Michael Wills. Working with a professional like the Orchard team, who has 26 years in the finance industry, could help your feel financially confident.

Licensing statements: Orchard Mortgage Brokers (Qld) Pty Ltd ACN 671 112 137 Trading As Orchard Mortgage Brokers is an authorised Credit Representative 556459 under Australian Credit Licence 389328 General disclaimer: This page provides general information only and has been prepared without taking into account your objectives, financial situation or needs. We recommend that you consider whether it is appropriate for your circumstances and your full financial situation will need to be reviewed prior to acceptance of any offer or product. Subject to lenders terms and conditions, fees and charges and eligibility criteria apply