Are you relying on an inheritance to secure your retirement?

Almost one third of all Australians may be relying on the inheritance to pay off the mortgage and ensure their financial security in retirement, according to recent research from IPSOS and MLC, the “Australia today” report.

Lifestyle trumps mortgage as a goal for the future

The issue seems to be our ability to pay off the mortgage and maintain our lifestyle, with 78% of Australians agreeing the mortgage has a big impact on their lifestyle, regardless of their wealth.

Australians’ main goals for the future showed that ‘maintaining standard of living’ came out on top, with 67% of Australians citing this as a key goal for the future. Our mortgage still remains a key concern, with almost half of us (48%) indicating that paying off the mortgage is a key goal for the future.

Interestingly, we’re not confident about how we’ll maintain our lifestyle or pay off our mortgages, with 60% of Australians saying that their salary hasn’t kept up with their standard of living.

For many of us, we’re not sure how we’ll manage, and many are leaving the mortgage up to a hopeful inheritance.

Higher lifestyle costs make budgeting difficult

The vast majority of Australians, 83%, believe today’s cost of living is much higher than it was 10 years ago and 69% believe that the high cost of living means that average Australians are struggling to make ends meet. Many Australians are taking measures to improve their weekly budgets, with 59% shopping at discount supermarkets like Aldi and Costco in order to save money.

Financial professionals offer greater financial security

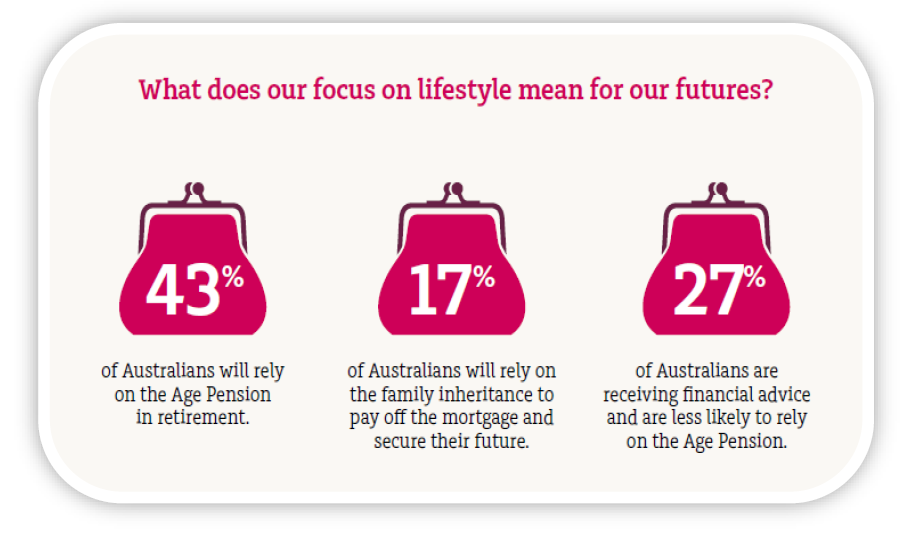

Many Australians across classes are not confident they have enough assets to support their retirement, so many are relying on the inheritance to pay off the mortgage. While around 17% are definitely relying on the inheritance to pay off the mortgage, it’s also a possibility for an additional 14%. Interestingly, rates are higher for those in Melbourne, with 22% of people relying on the inheritance and people with children (20%).

Those already engaging the help of a financial professional are less likely to rely on an inheritance to pay off their mortgage or to ensure their financial security. Of those with financial planners or advisers, 77% disagree that they’re relying on the inheritance as opposed to 67% of the total research sample.

Banking on a wish and a prayer

For many Australians, banking on the inheritance may be like banking on a wish and a prayer. Many baby boomers, who spent their 20s and 30s having children and working, far earlier than current generations, are now looking forward to enjoying their retirement, spending money traveling overseas and buying gifts for their children and grandchildren.

Laura Demasi from IPSOS Research agrees. “The baby boomers are the biggest travellers. The idea of spending the kids inheritance isn’t ideal for them and most would like to give something to their children, but a lot will be forced to take out reverse mortgages for aged care.”

The baby boomers are also living longer, and the longer we live, the more reliance we have on aged care assistance. The need for aged care is growing in Australia and many of our parents will need to draw down on their mortgage to help pay for aged care facilities.

Talk to your accountant or financial planner about how you can pay off your mortgage sooner using current income, with smart mortgage repayment strategies. Every year without a mortgage can make a big difference to your retirement savings.

You can also set in place a regular household budget and stick to it. It also helps to keep a good relationship with your parents, to actively care for them and help manage their aged care through their later years.

The many ways to protect your family.

When it comes to the people that are important to us, we have an inbuilt desire to keep them safe. For the ones we love this is particularly true, so here are some areas to consider when keeping your family protected.

Embrace online but stay mindful

In an increasingly online world, things change fast but it’s something we need to embrace. Here are a couple of tips to help stay protected:

- Use secure passwords

- Educate your family on potential risks when online

- Keep software and anti-virus up to date

Social media – Friend or Foe?

Hashtags, snapchats and all that come with them are a reality of our socially connected world. With all the positives social media brings, there are also risks like online stalkers, cyber bullies and scammers. Resources like the government’s E Safety website can help educate and provide strategies to keep your family safe.

Ensure Financial Security

Insurance can be an effective measure to help ensure financial security, particularly in unforeseen circumstances. Income Protection insurance can provide up to 75% of your income should you be off work due to serious illness or injury, while life insurance provides a lump sum payment in the event of death or terminal illness that can be used to cover ongoing mortgage repayments, household costs or even provide for your children’s education.

Rainy Days or Dream Holidays

ittle amounts over a long time can add up to a lot. Tucking away whatever spare cash you can afford can grow into something more meaningful when you need it. Whether it is used for an emergency, or a holiday to bring the family together, it’s an added piece of protection worth investing in.

Keep an open door

As they say, a problem shared is a problem halved. It might sound obvious, but being available to talk to your loved ones is extremely important when keeping your family protected. A relationship built on trust allows potential problems to be shared early so they can be overcome.

Maintain your affairs

Regardless of whether it happens tomorrow or in 50 years time, death will have a huge impact on the lives of the people you love. While not the nicest thing to think about, having an up to date will and power of attorney will reduce further heartache and ensure your family’s interests are protected.

Career change – The jobs of the future

Recently futurists Mark McCrindle and Anders Sorman-Nilsson spoke about where the world is headed and what are the possible jobs of the future.

Drone Traffic Manager

With drones set to become a multi-billion dollar industry by the 2020s, the airspace up to 152m could become abuzz with drones – and some clever people, and computers, will have to monitor the chaos. Meanwhile the Defence Force will increasingly hire drone pilots. “Who will be the best person at flying a drone? Probably someone who grew up playing virtual computer games and is skilled with controls – it might be a kid who’s used to flying drone missions via simulator,” Sorman-Nilsson points out.

Cognitive Computing Engineers

It’s all well and good to have incredible new robotic capabilities, but people will remain crucial for bridging the gap between technology and the human experience.

“Cognitive computing engineers understand robotics and technology but help those systems become more intuitive and human,” McCrindle explains. “Never before was a technologist required to have a behavioural science background.”

Coding Ethicists

As hands-free cars and technological automation becomes more commonplace, so too do the ethical dilemmas that face companies – and they’ll look to ethicists to problem solve likely legal scenarios. Say for example a self-driving vehicle is about to be in a dangerous collision with another car – which driver will be protected? “Coding is not just going to be about the ones and zeros but coding for ethical decision making,” Sorman-Nilsson says.

Virtual Managers

imply being a charismatic leader may not be enough to stack up as a future workplace manager. Sorman-Nilsson says managers will need the skills to manage virtual teams, which could actually be developed playing something like World of Warcraft from a young age. “[Players] understand diversity and have never met their peers they are playing with,” Sorman Nilsson explains. “They might take that skill directly into working for American Express or any other global organisation where the workforce is distributed around the world.”

Technology Educators

Gen Y, Z and alphas might be dab hands at technology use but as the Baby Boomers stay working into their late 60s and 70s, they’re going to need to keep up – and that’s a real opening for tech savvy millennials. “An opportunity we are going to see is up-skilling baby boomers on technology,” man-Nilsson explains. “We need to invest in keeping our baby boomers and the experience they have in terms of human intelligence and experience, but they need to be complemented with great technology skills.”

Cyber Security Guards

Beyond just hiring physical security at important events, organisations will increasingly employ cyber security personnel to protect events and companies from cyber attacks that could result in power outages or sound system failures. “Cyber security professionals will also be hired by everyone who has a mailing list or online store or collects data, so skills are required there,” McCrindle says.

Download the full article here

Licensing statements: Orchard Mortgage Brokers (Qld) Pty Ltd ACN 671 112 137 Trading As Orchard Mortgage Brokers is an authorised Credit Representative 556459 under Australian Credit Licence 389328 General disclaimer: This page provides general information only and has been prepared without taking into account your objectives, financial situation or needs. We recommend that you consider whether it is appropriate for your circumstances and your full financial situation will need to be reviewed prior to acceptance of any offer or product. Subject to lenders terms and conditions, fees and charges and eligibility criteria apply