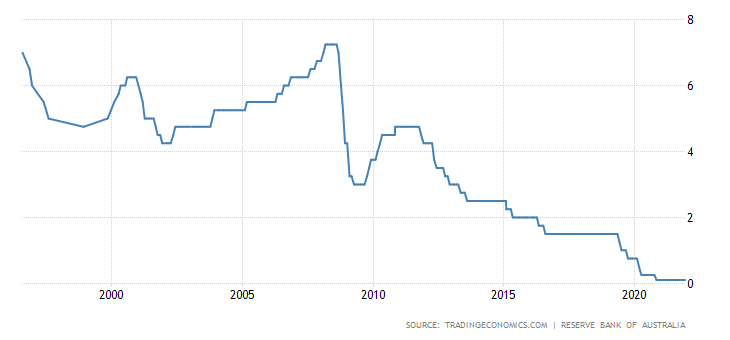

The age-old questions when do I fix my interest rate or just leave everything on variable?

No one can answer that question for you, but research is the key, to the answer. Please see below a summary from Trading Economics Web Site 09/12/2021:

The Reserve Bank of Australia kept the cash rate unchanged at a record low of 0.1% for the 13th month in a row during its last meeting of 2021 as expected, saying inflation had picked up but it remains low in underlying terms. Policymakers noted that inflation pressures are less than they are in many other countries, amid modest wages growth. The board reiterated that it will not increase the cash rate until Australia’s actual inflation is sustainably within the 2% to 3% target range. “This will require the labour market to be tight enough to generate wages growth that is materially higher than it is currently. This is likely to take some time and the board is prepared to be patient.”

The question is can it go any lower? Only time will tell!

While you ponder the interest rates going into 2022. We would like to wish you and your family a great Christmas and an even better 2022!

Licensing statements: Orchard Mortgage Brokers (Qld) Pty Ltd ACN 671 112 137 Trading As Orchard Mortgage Brokers is an authorised Credit Representative 556459 under Australian Credit Licence 389328 General disclaimer: This page provides general information only and has been prepared without taking into account your objectives, financial situation or needs. We recommend that you consider whether it is appropriate for your circumstances and your full financial situation will need to be reviewed prior to acceptance of any offer or product. Subject to lenders terms and conditions, fees and charges and eligibility criteria apply

Your full financial situation would need to be reviewed prior to acceptance of any offer or product.